channelchek podcast series

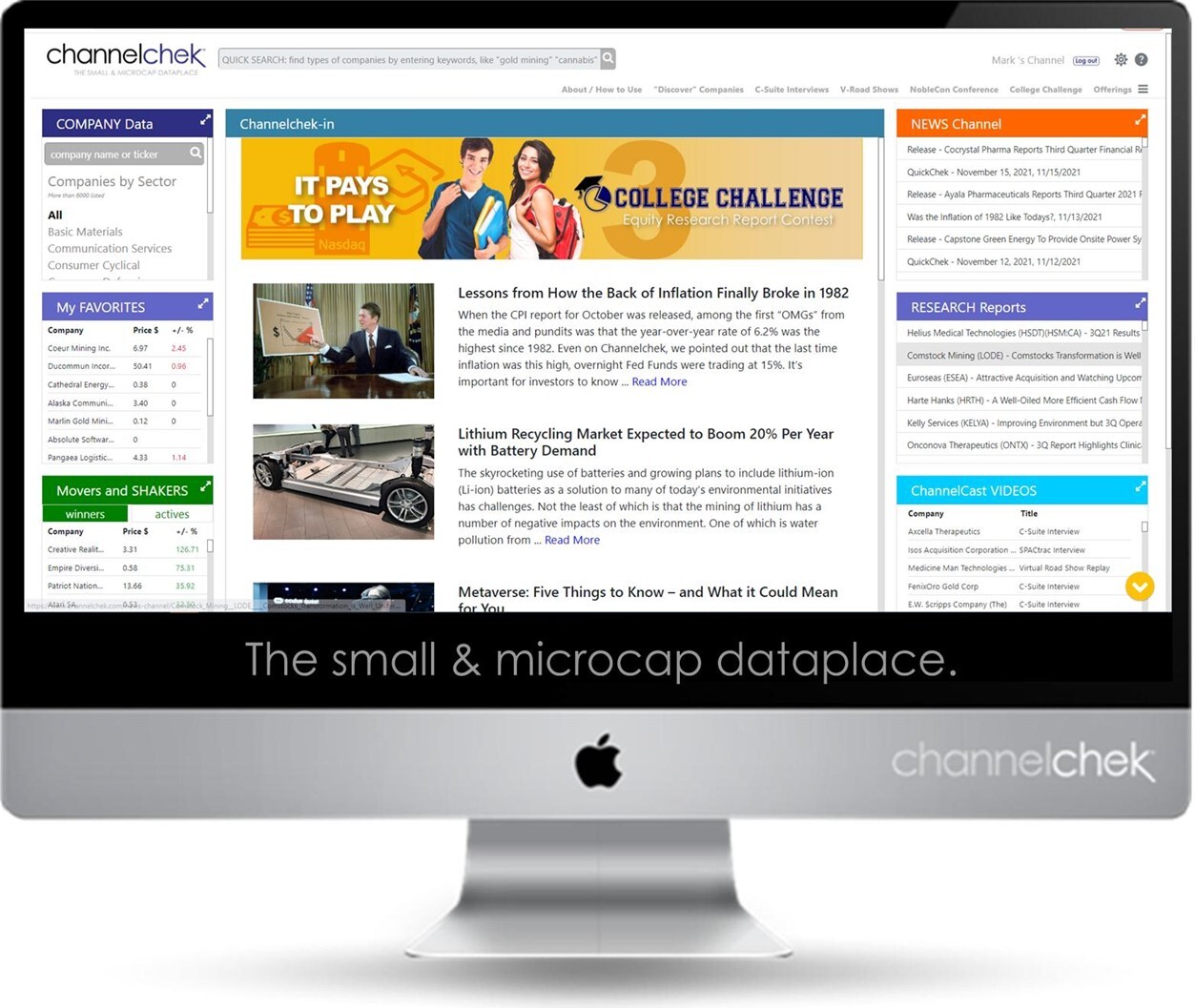

channelchek - Access to Tomorrow’s Market Movers A podcast interview series featuring c-suite executives from smallcap and microcap publicly traded companies. channelchek is a small and microcap focused investor portal, featuring news, video content, market data, and equity research from Noble Capital Markets, a FINRA licensed, SEC registered broker dealer. Registration for channelchek.com is offered at no cost to every level of investor.

Episodes

Monday Dec 05, 2022

Monday Dec 05, 2022

Recorded November 30, 2022. Noble Capital Markets Senior Research Analyst Mark Reichman sits down with LithiumBank CEO Robert Shewchuk for this exclusive interview. Topics covered include:

An overview of LithiumBank Resources operations and leadership

How LithiumBank proposes to produce a battery grade lithium product

What is unique about the reservoirs that underpin their claims that make them well suited to lithium production?

What are their immediate goals; how do they see the resources evolving?

When might commercial production commence?

How should investors view LithiumBank’s land packages?

Cash position and funding needs for 2023; Why is now a good time to invest?

Research, News, and Market Data on LithiumBank: https://channelchek.com/company/lbnkf

About LithiumBank Resources Corp.

LithiumBank Resources Corp. is an exploration and development company focused on lithium-enriched brine projects in Western Canada where low-carbon-impact, rapid DLE technology can be deployed. LithiumBank currently holds over 4.07 million acres of mineral titles, 3.68M acres in Alberta and 326K acres in Saskatchewan. LithiumBank’s mineral titles are strategically positioned over known reservoirs that provide a unique combination of scale, grade and exceptional flow rates that are necessary for a large-scale direct brine lithium production. LithiumBank is advancing and de-risking several projects in parallel of the Boardwalk Lithium Brine Project.

Friday Dec 02, 2022

Friday Dec 02, 2022

Recorded November 10, 2022. Noble Capital Markets Senior Research Analyst Joe Gomes sits down with Commercial Vehicle Group CEO Harold Bevis and CFO Andy Cheung for this exclusive interview. Topics covered include:

Overview of markets, growth rates, and potential

Progress on price-renegotiation with large customers; what still needs to be done?

Where are recent business wins coming from?

What to expect from the new Phoenix facility and future production facilities

CVG’s opportunity in the warehouse automation space

Is CVG involved in too many market segments? Will M&A remain an important piece?

Biggest challenges for 2023 and beyond

Research, News, and Market Data on Commercial Vehicle Group: https://channelchek.com/company/cvgi

About Commercial Vehicle Group

CVG is a leading supplier of warehouse automation and robotic assemblies, electric vehicle assemblies, electrical wire harnesses, seating systems, mechanical assemblies, structures, plastic products and more to the ecommerce, transportation, warehousing, construction equipment, industrial and recreational vehicle markets.

Friday Nov 18, 2022

Friday Nov 18, 2022

Recorded November 15, 2022. Noble Capital Markets Senior Research Analyst Mark Reichman sits down with Aurania Resources CEO, President, and Chairman Keith Barron for this exclusive interview. Topics covered include:

A Summary of Aurania’s flagship project

The Lost Cities inherent advantages – What would make it attractive to a major?

What have exploration programs revealed in terms of mineralization? What is the approach going forward?

What is most exciting about the Awacha and Tatasham targets? – When is drilling expected?

Where is there potential for joint ventures?

What catalysts or events will drive the stock value over the next 6-12 months?

Research, News, and Market Data on Aurania Resources: https://channelchek.com/company/auiaf

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

Friday Nov 18, 2022

Friday Nov 18, 2022

Recorded November 4, 2022. Noble Capital Markets Senior Research Analyst Gregory Aurand sits down with ChitogenX CEO Phil Deschamps for this exclusive interview. Topics covered include:

How the name change to ChitogenX better reflects the company’s values and core competencies

The strengths of the leadership team

What is chitosan? – what is the value add in utilizing it in soft tissue surgery?

Pre-clinical meniscal repair study – what data points can be expected?

What other market opportunities are on the horizon for the platform?

Investigating the market opportunity for developing their own medical grade chitosan

Research, News, and Market Data on ChitogenX: https://channelchek.com/company/chnxf

About ChitogenX

ChitogenX Inc. is a clinical stage regenerative medicine company dedicated to the development of novel therapeutic tissue repair technologies to improve tissue healing. The Company is committed to the clinical development of its proprietary RESTORE technology platform, a muco-adhesive CHITOSAN based biopolymer matrix, specifically designed to deliver biologics such as platelet-rich plasma (PRP) or bone marrow aspirate concentrate (BMAC), to enhance healing in various Regenerative Medicine Applications. Other formulations are being developed to leverage the technology's performance characteristics such as tissue adhesion, pliability, and ability to deliver biologics or therapeutics to various tissues damaged by trauma or disease. Further information about ChitogenX is available on the Company's website at www.chitogenx.com and on SEDAR at www.sedar.com.

Tuesday Oct 25, 2022

Tuesday Oct 25, 2022

Recorded October 21, 2022. Noble Capital Markets Senior Research Analyst Mark Reichman sits down with Lifeway Foods President & CEO Mac Balkam for this exclusive interview. Topics covered include:

A brief overview of Eskay’s projects, inherent advantages, and goals

What competitive advantages Eskay’s team brings to the table

What has Eskay accomplished to date, and what remains?

What they’ve learned from previous drilling; how it affects 2023 activities

Why is now the time to consider investing in Eskay Mining Corp?

Near-term catalysts and milestones; when are assay results expected?

Research, News, and Market Data on Eskay Mining: https://channelchek.com/company/eskyf

About Eskay Mining

Eskay Mining Corp (TSX-V:ESK) is a TSX Venture Exchange listed company, headquartered in Toronto, Ontario. Eskay is an exploration company focused on the exploration and development of precious and base metals along the Eskay rift in a highly prolific region of northwest British Columbia known as the “Golden Triangle,” 70km northwest of Stewart, BC. The Company currently holds mineral tenures in this area comprised of 177 claims (52,600 hectares).

Tuesday Sep 13, 2022

Tuesday Sep 13, 2022

Recorded September 8, 2022. Noble Capital Markets Senior Research Analyst Joe Gomes sits down with Lifeway Foods President & CEO Julie Smolyansky and CFO Eric Hanson for this exclusive interview. Topics covered include:

An overview of Lifeway’s history and product portfolio

What is kefir? What is Lifeway’s current kefir market share?

More on the recently resolved proxy fight and accounting issues

Value added by the 2021 GlenOaks acquisition. Future M&A strategy.

What lead to recent strong growth? How can it continue?

How has the company been affected by inflation, supply chain, and staffing challenges?

Research, News, and Market Data on Lifeway Foods: https://channelchek.com/company/lway

Lifeway Foods, Inc., which has been recognized as one of Forbes’ Best Small Companies, is America’s leading supplier of the probiotic, fermented beverage known as kefir. In addition to its line of drinkable kefir, the company also produces cheese, probiotic oat milk, and a ProBugs line for kids. Lifeway’s tart and tangy fermented dairy products are now sold across the United States, Mexico, Ireland and France. Learn how Lifeway is good for more than just you at lifewayfoods.com

Thursday Sep 08, 2022

Thursday Sep 08, 2022

Recorded August 30, 2022. Noble Capital Markets Senior Research Analyst Michael Heim sits down with InPlay Oil President & Doug Bartole for this exclusive interview. Topics covered include:

How has InPlay reacted to recent energy sector strength?

How have drilling costs been affected by inflation and increased production?

Behind the decision to raise their credit facility while paying down debt

The current acquisition landscape

How sustainable are the current oil prices?

Why is Inplay and attractive way to invest in the energy space?

Research, News, and Market Data on InPlay Oil: https://channelchek.com/company/ipoof

InPlay Oil Corp. is a growth-oriented light oil development and production company based in Calgary, Alberta. InPlay’s activity is focused on large oil in place pools with low recovery factors, low declines, and long life reserves primarily targeting the Cardium Formation in Alberta. InPlay has a strong balance sheet allowing it to weather commodity volatility and develop its extensive inventory of horizontal drilling locations. InPlay’s shares trade on the Toronto Stock Exchange under the symbol IPO.

Tuesday Jul 19, 2022

Tuesday Jul 19, 2022

Recorded July 13, 2022. Noble Capital Markets Senior Research Analyst Mark Reichman sits down with Labrador Gold President & CEO Roger Moss for this exclusive interview. Topics covered include:

An overview of Labrador’s 4 properties in Canada; The business climate in Newfoundland

The significance of the Appleton Fault to the Kingsway project

Major targets of the 100,000 meter drill program

When are they expected to transition from exploration drilling to resource definition?

Labrador’s share structure and balance sheet strength

Near-term catalysts; Why is now a good time to invest?

Research, News, and Market Data on Labrador Gold: https://channelchek.com/company/NKOSF

About Labrador GoldLabrador Gold is a Canadian based mineral exploration company focused on the acquisition and exploration of prospective gold projects in Eastern Canada.

Labrador Gold’s flagship property is the 100% owned Kingsway project in the Gander area of Newfoundland. The three licenses comprising the Kingsway project cover approximately 12km of the Appleton Fault Zone which is associated with gold occurrences in the region, including those of New Found Gold immediately to the south of Kingsway. Infrastructure in the area is excellent located just 18km from the town of Gander with road access to the project, nearby electricity and abundant local water. LabGold is drilling a projected 100,000 metres targeting high-grade epizonal gold mineralization along the Appleton Fault Zone with encouraging results. The Company has approximately $26.5 million in working capital and is well funded to carry out the planned program.

The Hopedale property covers much of the Florence Lake greenstone belt that stretches over 60 km. The belt is typical of greenstone belts around the world but has been underexplored by comparison. Work to date by Labrador Gold show gold anomalies in rocks, soils and lake sediments over a 3 kilometre section of the northern portion of the Florence Lake greenstone belt in the vicinity of the known Thurber Dog gold showing where grab samples assayed up to 7.8 g/t gold. In addition, anomalous gold in soil and lake sediment samples occur over approximately 40 km along the southern section of the greenstone belt (see news release dated January 25 th 2018 for more details). Labrador Gold now controls approximately 40km strike length of the Florence Lake Greenstone Belt.

The Company has 168,889,979 common shares issued and outstanding and trades on the TSX Venture Exchange under the symbol LAB.

Wednesday Jun 29, 2022

Wednesday Jun 29, 2022

Recorded June 21, 2022. Noble Capital Markets Senior Research Analyst Michael Heim sits down with Alovpetro Energy President & CEO Corey Ruttan for this exclusive interview. Topics covered include:

What makes the Reconcavo basin an attractive place to invest

Alvopetro’s unique price resetting mechanism

Outlook for operating costs going forward

Achieving the 25% production increase goal; Is demand high enough?

Any acquisition opportunity on the horizon?

Reasons for recent stock price performance; why is now a good time to invest?

Research, News, and Market Data on Alvopetro: https://channelchek.com/company/ALVOF

Alvopetro Energy Ltd.'s vision is to become a leading independent upstream and midstream operator in Brazil. Our strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of our Caburé natural gas field and our strategic midstream infrastructure.

Wednesday Jun 22, 2022

Wednesday Jun 22, 2022

Recorded June 16, 2022. Noble Capital Markets Senior Research Analyst Joe Gomes sits down with Great Lakes Dredge & Dock President & CEO Lasse Petterson and SVP, US Offshore Wind Eleni Beyko for this exclusive interview. Topics covered include:

An introduction to Great Lakes’ new offshore wind division; market size and opportunities

Why is offshore wind such an exciting opportunity for the company?

Update on the rock installation vessel currently under construction

The Jones Act – Impacts on competition in the dredging and wind divisions

What is driving growth in the dredging market?

What are Great Lakes’ biggest challenges going forward?

Research, News, and Market Data on Great Lakes: https://channelchek.com/company/GLDD

About Great Lakes

Great Lakes Dredge & Dock Corporation is the largest provider of dredging services in the United States. In addition, Great Lakes is fully engaged in expanding its core business into the rapidly developing offshore wind energy industry. The Company has a long history of performing significant international projects. The Company employs experienced civil, ocean and mechanical engineering staff in its estimating, production and project management functions. In its over 132-year history, the Company has never failed to complete a marine project. Great Lakes owns and operates the largest and most diverse fleet in the U.S. dredging industry, comprised of approximately 200 specialized vessels. Great Lakes has a disciplined training program for engineers that ensures experienced-based performance as they advance through Company operations. The Company’s Incident-and Injury-Free® (IIF®) safety management program is integrated into all aspects of the Company’s culture. The Company’s commitment to the IIF® culture promotes a work environment where employee safety is paramount.

channelchek

Channelchek (www.channelchek.com) is a comprehensive investor-centric portal featuring more than 6,000 emerging growth companies that provides advanced market data, independent research, balanced news, video webcasts, exclusive c-suite interviews, and access to virtual road shows. The site is available to the public at every level without cost or obligation. Research on Channelchek is provided by Noble Capital Markets, Inc., an SEC / FINRA registered broker-dealer since 1984. For more information email contact@channelchek.com.