channelchek podcast series

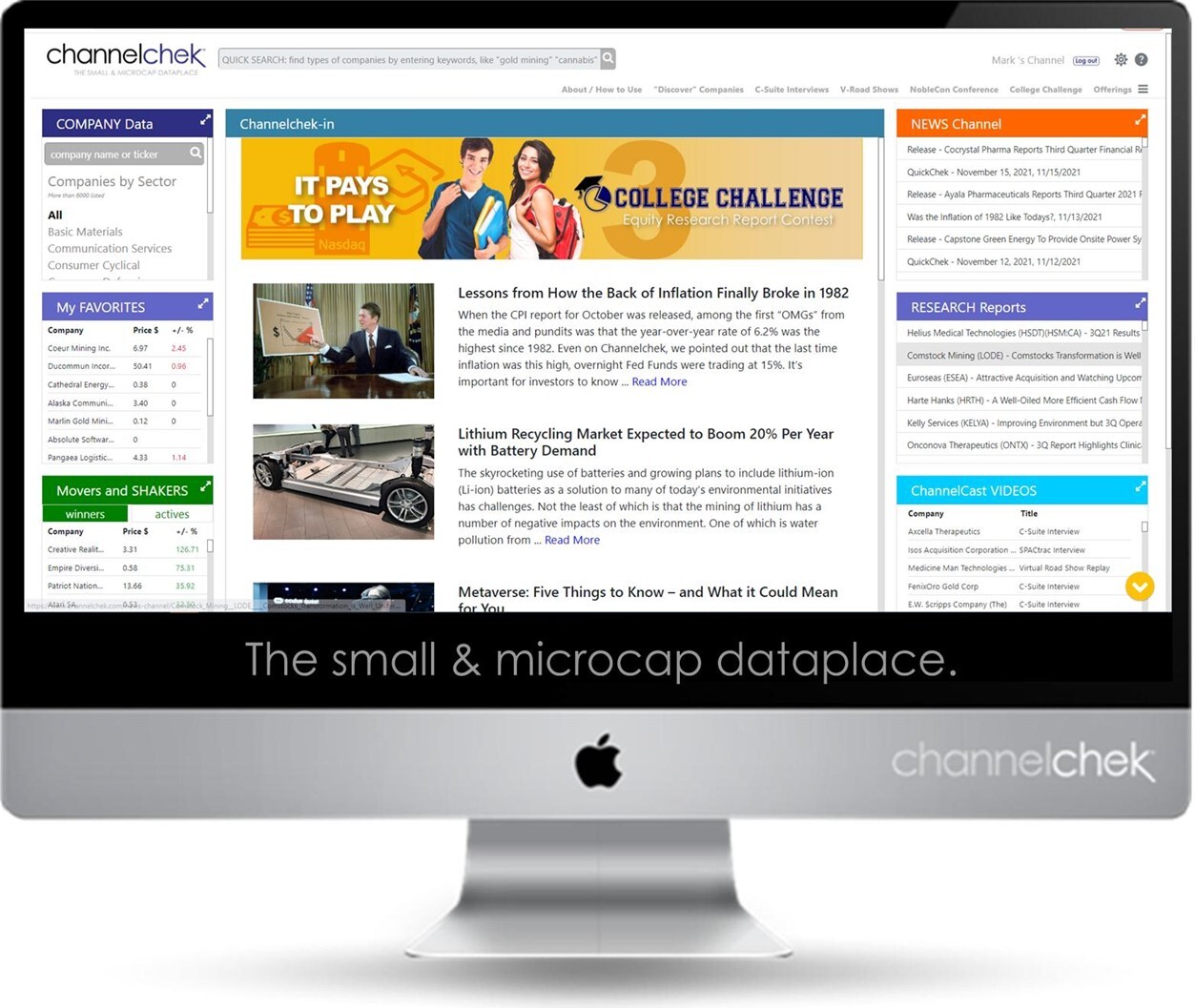

channelchek - Access to Tomorrow’s Market Movers A podcast interview series featuring c-suite executives from smallcap and microcap publicly traded companies. channelchek is a small and microcap focused investor portal, featuring news, video content, market data, and equity research from Noble Capital Markets, a FINRA licensed, SEC registered broker dealer. Registration for channelchek.com is offered at no cost to every level of investor.

Episodes

Tuesday Jun 21, 2022

Tuesday Jun 21, 2022

Recorded June 14, 2022. Noble Capital Markets Senior Research Analyst Mark Reichman sits down with Maple Gold Mines President & CEO Matthew Hornor for this exclusive interview. Topics covered include:

An overview of Maple Gold’s projects and properties; strategic goals and drilling objectives for 2022

Detail on the Agnico Eagle strategic partnership

Douay Project – Mineralization zones; Best opportunities to expand resource

Capital structure, balance sheet strength, & how funding is split between projects

Near time milestones investors should watch for

What are Maple’s competitive advantages; Why is now a good time to invest?

Research, News, and Market Data on Maple Gold: https://channelchek.com/company/MGMLF

The C-Suite Interview Series is now available in podcast format: https://channelchek.podbean.com/

About Maple Gold

Maple Gold Mines Ltd. is a Canadian advanced exploration company in a 50/50 joint venture with Agnico Eagle Mines Limited to jointly advance the district-scale Douay and Joutel gold projects located in Quebec's prolific Abitibi Greenstone Gold Belt. The projects benefit from exceptional infrastructure access and boast ~400 km2 of highly prospective ground including an established gold resource at Douay (SLR 2022) that holds significant expansion potential as well as the past-producing Eagle, Telbel and Eagle West mines at Joutel. In addition, the Company holds an exclusive option to acquire 100% of the Eagle Mine Property.

The district-scale property package also hosts a significant number of regional exploration targets along a 55 km strike length of the Casa Berardi Deformation Zone that have yet to be tested through drilling, making the project ripe for new gold and polymetallic discoveries. The Company is well capitalized and is currently focused on carrying out exploration and drill programs to grow resources and make new discoveries to establish an exciting new gold district in the heart of the Abitibi. For more information, please visit www.maplegoldmines.com.

Tuesday May 31, 2022

Tuesday May 31, 2022

Recorded May 19, 2022. Noble Capital Markets Senior Research Analyst Joe Gomes sits down with Schwazze CEO & Chairman Justin Dye for this exclusive interview. Topics covered include:

An update on recent growth in retail and cultivation

What makes Colorado & New Mexico such attractive markets?

Dealing with wholesale supply, demand, and pricing challenges

Building synergies and adding value through acquisitions

The prospects for federal cannabis legalization

What steps can Schwazze take to bridge the current perceived stock price discount?

Research, News, and Market Data on Schwazze: https://channelchek.com/company/SHWZ

About Schwazze

Schwazze (OTCQX:SHWZ, NEO:SHWZ) is building a premier vertically integrated regional cannabis company with assets in Colorado and New Mexico and will continue to take its operating system to other states where it can develop a differentiated regional leadership position. Schwazze is the parent company of a portfolio of leading cannabis businesses and brands spanning seed to sale. The Company is committed to unlocking the full potential of the cannabis plant to improve the human condition. Schwazze is anchored by a high-performance culture that combines customer-centric thinking and data science to test, measure, and drive decisions and outcomes. The Company's leadership team has deep expertise in retailing, wholesaling, and building consumer brands at Fortune 500 companies as well as in the cannabis sector. Schwazze is passionate about making a difference in our communities, promoting diversity and inclusion, and doing our part to incorporate climate-conscious best practices.

Medicine Man Technologies, Inc. was Schwazze's former operating trade name. The corporate entity continues to be named Medicine Man Technologies, Inc. Schwazze derives its name from the pruning technique of a cannabis plant to enhance plant structure and promote healthy growth.

Monday May 23, 2022

Monday May 23, 2022

Recorded May 18, 2022. Noble Capital Markets Senior Research Analyst Joe Gomes sits down with FAT Brands President & CEO Andrew Wiederhorn for this exclusive interview. Topics covered include:

What has fueled FAT Brands’ 600% growth

An update on the management structure

Returning to pre-covid levels; has delivery dropped off as customers return to restaurants?

The impact of inflation and supply chain constraints

The outlook for future acquisitions

What catalysts will move the stock price?

Research, News, and Market Data on FAT Brands: https://channelchek.com/company/FAT

The C-Suite Interview Series is now available in podcast format: https://channelchek.podbean.com/

About FAT (Fresh. Authentic. Tasty.) Brands

FAT Brands (NASDAQ: FAT) is a leading global franchising company that strategically acquires, markets, and develops fast casual, quick-service, casual dining, and polished casual dining concepts around the world. The Company currently owns 17 restaurant brands: Round Table Pizza, Fatburger, Marble Slab Creamery, Johnny Rockets, Fazoli’s, Twin Peaks, Great American Cookies, Hot Dog on a Stick, Buffalo’s Cafe & Express, Hurricane Grill & Wings, Pretzelmaker, Elevation Burger, Native Grill & Wings, Yalla Mediterranean and Ponderosa and Bonanza Steakhouses, and franchises and owns over 2,300 units worldwide.

Tuesday Mar 22, 2022

Tuesday Mar 22, 2022

Recorded March 4, 2022. Noble Capital Markets Senior Research Analyst Michael Kupinski sits down with Forbes CEO Mike Federle and CFO Mike York for this exclusive interview.

What model is the company pursuing?

How Forbes managed to succeed during a global pandemic

What are Forbes’ opportunities for growth?

The SPAC transaction with Magnum Opus

Opportunities as a public company

View an exclusive SPAC report on Forbes: https://channelchek.com/company/OPA

About Forbes

Forbes champions success by celebrating those who have made it, and those who aspire to make it. Forbes convenes and curates the most influential leaders and entrepreneurs who are driving change, transforming business and making a significant impact on the world. The Forbes brand today reaches more than 150 million people worldwide through its trusted journalism, signature LIVE and Forbes Virtual events, custom marketing programs and 44 licensed local editions in 77 countries. Forbes Media’s brand extensions include real estate, education and financial services license agreements.

Forbes recently announced plans to go public through a business combination with Magnum Opus (NYSE: OPA), a special purpose acquisition company (SPAC), which is expected to close in Q1 of 2022.

Tuesday Mar 08, 2022

Tuesday Mar 08, 2022

Recorded March 2, 2022. Noble Capital Markets Senior Research Analyst Mark Reichman sits down with Aurania Resources CEO, President, and Chairman Keith Barron for this exclusive interview. Topics covered include:

A summary of Aurania’s landholdings; Mineralization discovered to-date

What lead to the decision to narrow Aurania’s focus?

Immediate plans to explore core concessions

Potential joint ventures, and the upside for shareholders

How the hiring of Carolina Lasso Amaya helps Aurania gain access to more areas

Aurania’s financial position & expected milestones for 2022

Research, News, and Market Data on Aurania Resources: https://channelchek.com/company/AUIAF

About Aurania

Aurania is a mineral exploration company engaged in the identification, evaluation, acquisition and exploration of mineral property interests, with a focus on precious metals and copper. Its flagship asset, The Lost Cities – Cutucu Project, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

Wednesday Mar 02, 2022

Wednesday Mar 02, 2022

Recorded February 15, 2022. Noble Capital Markets Senior Research Analyst Michael Kupinski sits down with Beasley Media Group CEO Caroline Beasley for this exclusive interview. Topics covered include:

Why is now such an exciting time for Beasley?

How is Beasley approaching the evolution of the radio industry?

What changed during the pandemic and what has fueled recovery?

Taking advantage of multiple digital revenue streams

The outlook for midterm political advertising

Leveraging current financial flexibility to grow through M&A opportunities

Research, News, and Market Data on Beasley Media Group: https://channelchek.com/company/BBGI

About Beasley Media Group

The Company owns and operates 62 stations (47 FM and 15 AM) in 15 large- and mid-size markets in the United States. Approximately 20 million consumers listen to the Company’s radio stations weekly over-the-air, online and on smartphones and tablets, and millions regularly engage with the Company’s brands and personalities through digital platforms such as Facebook, Twitter, text messaging, digital and web applications and email. The Overwatch League’s Houston Outlaws esports team is a wholly owned subsidiary. The Company also owns BeasleyXP, a national esports content hub, and AXLR-R8, a Rocket League Championship Series team, in its esports portfolio. For more information, please visit www.bbgi.com.

Tuesday Mar 01, 2022

Tuesday Mar 01, 2022

Recorded February 23, 2022. Noble Capital Markets Senior Research Analyst Gregory Aurand sits down with Baudax Bio President & CEO Gerri Henwood for this exclusive interview. Topics covered include:

An overview of Baudax Bio and their product profile

How are Anjeso commercial activities progressing? Has Covid shifted the strategy?

What proposed CDC opioid guidelines mean for Baudax

Long term opportunities for neuromuscular blocking agents

Does the recent stock split cure the Nasdaq difficiency?

What will get the stock moving in the right direction going forward?

Research, News, and Market Data on Baudax Bio: https://channelchek.com/company/BXRX

Baudax Bio is a pharmaceutical company focused on commercializing and developing innovative products for acute care settings. ANJESO is the first and only 24-hour, intravenous (IV) COX-2 preferential non-steroidal anti-inflammatory (NSAID) for the management of moderate to severe pain. In addition to ANJESO, Baudax Bio has a pipeline of other innovative pharmaceutical assets including two novel neuromuscular blocking agents (NMBs) and a proprietary chemical reversal agent specific to these NMBs. For more information, please visit www.baudaxbio.com.

Thursday Feb 10, 2022

Thursday Feb 10, 2022

Recorded February 2, 2022. Noble Capital Markets Senior Research Analyst Michael Kupinski sits down with Bowlero President & CFO Brett Parker for this exclusive interview. Topics include:

What led to the company to go public after a rich 25 year history

Competition, current market share, and the attractive growth outlook

What regions present the best opportunity for expansion?

The unique value-add that Bowlero brings to its bowling centers; what allows it to run at such high margins?

Leveraging PBA ownership to boost the marketing strategy

Recent stock performance; what will get the price moving in the right direction?

Research, News, and Market Data on Bowlero: https://channelchek.com/company/BOWL

Bowlero Corp. is the worldwide leader in bowling entertainment, media, and events. With more than 300 bowling centers across North America, Bowlero Corp. serves more than 26 million guests each year through a family of brands that includes Bowlero, Bowlmor Lanes, and AMF. In 2019, Bowlero Corp. acquired the Professional Bowlers Association, the major league of bowling, which boasts thousands of members and millions of fans across the globe. For more information on Bowlero Corp., please visit BowleroCorp.com.

Thursday Feb 10, 2022

Thursday Feb 10, 2022

Recorded January 6, 2022. Noble Capital Markets Senior Research Analyst Michael Kupinski sits down with Digerati Technologies CEO Arthur Smith for this exclusive interview. Topics include:

Highlights for the company over the past 4 months.

How have inflation, supply chain, and labor shortage issues affected Digerati?

Highlights from the three UCaaS case studies

The M&A strategy and outlook

Updates on the recently closed SkyNet Telecom Acquisition

Art's view on Digerati's stock performance and catalysts that will trigger growth.

Research, News, and Market Data on Digerati available on channelchek: https://channelchek.com/company/DTGI

Digerati Technologies, Inc. (OTCQB: DTGI) is a provider of cloud services specializing in UCaaS (Unified Communications as a Service) solutions for the business market. Through its operating subsidiaries T3 Communications (T3com.com) and Nexogy (Nexogy.com), the Company is meeting the global needs of businesses seeking simple, flexible, reliable, and cost-effective communication and network solutions including cloud PBX, cloud telephony, cloud WAN, cloud call center, cloud mobile, and the delivery of digital oxygen on its broadband network. Digerati has developed a robust integration platform to fuel mergers and acquisitions in a highly fragmented market as it delivers business solutions on its carrier-grade network and Only in the Cloud™.

channelchek

Channelchek (www.channelchek.com) is a comprehensive investor-centric portal featuring more than 6,000 emerging growth companies that provides advanced market data, independent research, balanced news, video webcasts, exclusive c-suite interviews, and access to virtual road shows. The site is available to the public at every level without cost or obligation. Research on Channelchek is provided by Noble Capital Markets, Inc., an SEC / FINRA registered broker-dealer since 1984. For more information email contact@channelchek.com.